Apps That Help Deck The Halls Without Topping Your Budget

You have a lot on your plate when it comes to the holidays, and we’re not talking about that gigantic slice of pumpkin pie.

Let’s have a guess at your holiday to-do list. There’s planning the family’s big dinner and making sure you stock the fridge for when they arrive. You need to pull out the decorations and spruce up the guest room before your cousins fly in from the other side of the country. There’s cards to send, gingerbread houses to make, and parties to attend. Oh, and let’s not forget about shopping for presents!

In the excitement of the season, it’s easy to put thoughts of your finances to the side. Splurging comes naturally at this time of year, especially if your priority is making the season the most festive yet for your children. The average American spends over $900 on gifts alone. (That means the average American won’t be adding the $1,000 iPhone X to their list). With the added cost of entertaining and travelling, many of them end up charging an additional $5,400 in the fourth quarter onto their credit cards.

That’s a lot of debt in exchange for just a few hours of celebration! Especially when you really want to be spending your money on the things you enjoy treating yourself with. Whether that’s a trip to the spa or even just buying more followers for your social media account! By researching into links such as https://increditools.com/buy-tiktok-views/ and many more, you can work on your Christmas budget by choosing the best sites to buy your likes from!

When your list of chores is as long as Santa’s beard, you may think you don’t have the time to budget, but you’d be wrong. Making a holiday budget is easier now more than ever. You don’t even need to crunch the numbers yourself if you use any of these award-winning money management apps.

- You Need a Budget

The aptly names You Need a Budget (or YNAB when you don’t have the time to say it in full) is a great option for those people living paycheck to paycheck – something nearly half of the country does. If that describes your financial arrangement, then accommodating the holidays are an even harder challenge.

YNAB is designed to help you tackle your debts by exploiting every dollar you earn. Creators of the app have nicknamed it a digital accountability partner because it forces you to work with the money you have and not a dollar more.

Though you will have to pay for the privilege of its addition on your phone, the average user pays off $600 in the first two months, so the small monthly or yearly fee- $4.17 or $50, respectively-is definitely worth it.

- Mint

By far one of the most popular money management apps in the world, Mint is one you’ve probably heard of it. There’s a reason why you have. Since it came out on the scene in 2006, it’s built a customer base of over 20 million users around the world.

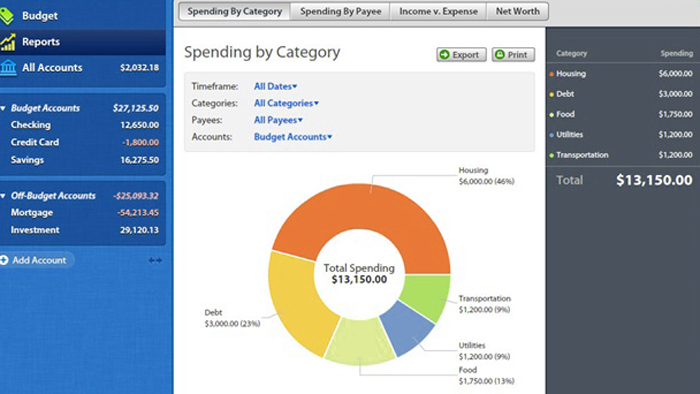

Its user-friendly interface makes it easy to create budgets and track spending, even if you suffer from mathematic anxiety. Once you connect your various accounts, it will aggregate your finances into one, easy-to-understand profile on your app. With a swipe of your finger, you’ll see when each bill is due and how much you can afford to pay, as well as your overall net worth.

- Acorns

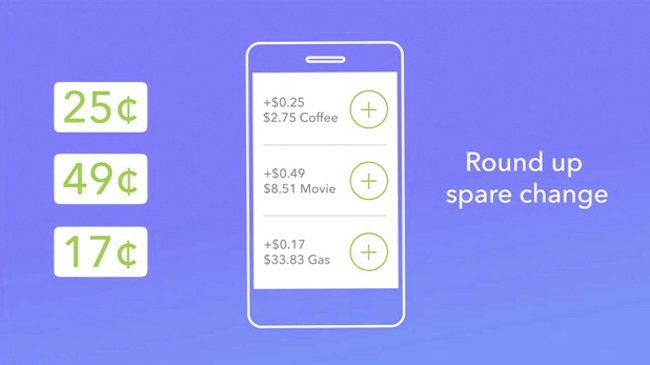

You spent the summer watching squirrels bury their nuts, so they have something to eat during the winter. The people behind Acorn were inspired by these bushy-tailed creatures’ preparedness, and created an app that helps squirrel away extra cash without really trying. Rather than hoarding nuts, this app reserves cents by rounding up the dollar amount of every purchase you make with a debit or credit card. It automatically invests the difference in a low-cost, low risk portfolio.

Before you know it, the cents add up. If you start early enough, Acorns can help you survive any big event or purchase in your life. While many of your friends or family may get approved for an online personal loan to cover the big things like the holidays, Acorns’ automatic investing will have developed the savings you need to avoid an emergency. Though they both do the job equally well, paying your debts with your own money is much more satisfying than relying on a convenient cash loan.

It, like YNAB, costs money, but it’s a pain-free way of saving worthy of the monthly $1 payment. You’ll be using your cards a lot throughout the season anyways. You might as well benefit from shopping!

- The Christmas List

While the others are handy apps you can use year-round, The Christmas List is specially designed for the holidays. They only come but once a year, so why not take advantage of a themed app while you still can?

It helps that The Christmas List is good at what it does. Beyond the red and green color scheme, it’s a functional app. It plays the role of personal assistant and financial analyst, letting you stay on top of your spending while you organize your shopping according to store, people, and gifts.

Because let’s face it – despite your best efforts to save on our own, the holidays work against you. You’re going to be doing a little shopping no matter what the state of your finances are.

If holiday spending comes to you as naturally as breathing, you can find yourself in debt from one inhalationto the next. Don’t let the season sour your finances in the New Year. With the right addition to your phone, you can create a budget that will stand up to the most wonderful time of the year. Check in with a money management app, and see how you can avoid debt in the New Year.

- Restaurant Germs: Improving Cleaning Practices For Commonly Contaminated Surfaces - April 15, 2024

- 11 Cancer-Fighting Foods to Reduce the Risk of Cancer - March 18, 2024

- Safety and Aesthetics: Tips for Landscaping Around Your Wellhead - February 20, 2024